The Pros And Cons Of Getting A Commercial Property Insurance In Stratford

Are you an entrepreneur running your business in Stratford? Do you believe you’ve safeguarded it in the best possible way? If yes, is Canadian commercial property insurance part of your safeguarding strategy? If not, you should consider taking out commercial property insurance coverage.

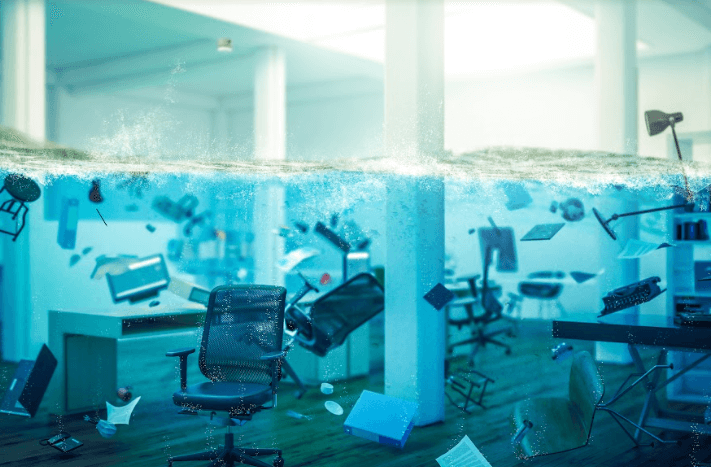

This coverage will cover your business assets, from the building itself and equipment, in the event of risks such as theft, fire, or natural disaster. Are you still pondering about it? Worry not; as a business owner, you often want to understand what you’re getting yourself into.

Luckily, this post will aid your understanding by discussing the pros and cons of commercial property insurance. Follow through with this read for insight.

The Pros Of Having Commercial Property Insurance In Stratford

Commercial property insurance has certain advantages. Some of them are the following:

- It Creates Strong Business Partnerships

There are many ways you can run your business. You might be the sole financier or have partners invested in your business. Investors tend to be wary of what to invest in regarding risk. A risky investment might make them lose their money.

Your business might be a risky investment if it’s not insured. A fire or natural disaster could bring down your enterprise, including the investors’ money. As a result, you’ll likely fail to get many investors in your business due to this fear. Those who agree to invest might only add small amounts of capital, which might not be enough for your business needs.

A commercial property insurance in Stratford reverses the situation. Since your business is secured financially, its risk factor is small, attracting investors. Additionally, they’ll invest large amounts of money, bringing about strong partnerships that lead to business growth.

- It Allows Proper Budgeting

Budgets are one of the ingredients of business success. They help you run operations within your financial muscle to avoid running out of money. Although it’s easy to formulate a budget, the challenge arises in adhering to it.

The lack of commercial property insurance is one of the aspects that’ll make sticking to your budget challenging.

The introduction has mentioned that this insurance coverage will cover risks like fire and theft. Suppose there’s a fire in your premises, which burns down most of your property, or there’s theft, and most of your machinery is gone. Without insurance, you must go into your business savings to replace damaged and lost items. These expenses were not part of your budget. You’ll end up offsetting it, which wasn’t part of the plan.

Yet your risks are taken care of with commercial property insurance in Stratford, should they occur. You’ll have done your part of paying premiums, meaning you won’t need to alter your budget to cater to damage. As a result, your operations will run smoothly as you planned, increasing the chances of achieving your financial goals.

- It Gives You Peace Of Mind

As a business, you’ve invested millions in acquiring your business assets. There’s a possibility you panic when you imagine losing these assets to a fire, especially if you don’t have insurance coverage. During heavy rain at night, you’re often fingers crossed that the rain won’t damage anything on your commercial property. It’s no way to live after all the years of hard work.

Nonetheless, with insurance, you’ll be at ease and sleep peacefully, knowing your business assets are safe. If a fire is a high risk to your business, you’ll have done your part of putting the necessary fire safety measures in place and paid premiums. The rest is left to your insurance provider.

The Cons Of Having Commercial Property Insurance In Startford

Sadly, commercial property insurance does have its drawbacks. They include:

- There’s Lengthy Compensation

If an insured risk occurs, the insurance provider should compensate you to help you cater to the damages. As easy as it might sound, it’s often not, which is where the problem arises.

Most insurance providers won’t pay outright after you file a claim. They’ll inspect your premises, assess the damage, and investigate the matter, a process that might take several months if you don’t follow up accordingly.

Imagine closing your business for three months due to a fire or theft that left your business with no equipment to run operations. The closure will give your competitors an added advantage as you lose customers to them, which isn’t good for business.

- It Adds To Expenses

For most businesses, making profits is often the end goal. They can only do this by managing their finances. One way to do this is to reduce expenses, and a commercial property insurance cover defeats this purpose.

As part of the deal, you must pay premiums to the insurance provider at the agreed intervals. Some will ask for monthly payments, others quarterly or yearly payments. If you run a large business, the risk factor is high. Hence, the premiums will be high. The same will happen if you live in an area prone to floods, increasing expenditure.

Generally, the premiums will become part of your business budget, yet they don’t bring returns, as is often the case with other expenses.

Conclusion

For the long-term success of your business, you must gear your efforts towards growth and minimize risks that could bring your business down. The discussion above states that a commercial property insurance cover is one of the mechanisms you can adopt to minimize risks. It has further discussed the pros and cons of this mechanism to help you decide. With this insight, you can make an informed decision on taking out the insurance coverage. Be sure to make the right decision for your business.