Manage Your Money with Ease_ The Power of a Financial Planning App

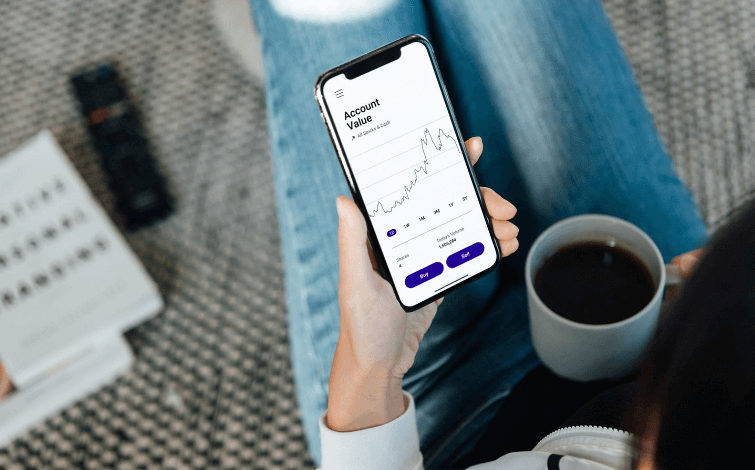

Modern life has seen us evolve from writing checks and visiting banks to direct deposits and online banking. As technology continues to advance, so too does our capacity to manage our finances with greater efficiency and simplicity. One significant development in this regard has been the advent of financial planning apps. These applications bring the power of financial management to our fingertips, allowing us to navigate our fiscal realities with unprecedented ease. This article will take a deep dive into the world of financial planning apps, exploring their benefits, how they function, and how they can transform your financial journey.

Understanding Financial Planning Apps

Financial planning apps are digital tools designed to simplify the process of personal finance management. They allow you to keep track of your income and expenses, create and stick to a budget, save towards specific goals, manage debts, and even make investments. They’re powered by state-of-the-art technologies, from data analytics that provide valuable insights into your spending habits to encryption techniques that ensure your financial data stays secure.

How Financial Planning Apps Make Money Management Easier

The conveniences offered by financial planning apps are numerous and significant. They’re an upgrade from traditional methods of personal finance management in several key ways:

1. Streamlined Tracking of Income and Expenses

With a financial planning app, gone are the days of keeping paper receipts or manually entering every transaction into a spreadsheet. These apps automatically categorize your transactions, allowing you to see at a glance where your money is coming from and where it’s going.

2. Hassle-Free Budgeting

Budgeting is made easy with financial planning apps. They allow you to set spending limits for different categories and alert you when you’re nearing or have exceeded these limits. This makes it easier to control your spending and save more.

3. Goal-Oriented Saving

Whether you’re saving for a vacation, a new car, or your retirement, financial planning apps allow you to set specific goals and track your progress towards them. They can also automate the saving process, periodically transferring money from your checking account to a savings account or investment portfolio.

4. Efficient Debt Management

For those grappling with debt, financial planning apps can be a lifeline. They can help you keep track of your debts, calculate your debt payoff dates, and create customized repayment plans. They can even prioritize your debts based on interest rates, helping you save money in the long run.

5. Simplified Investments

Many financial planning apps provide investment options, allowing you to grow your wealth. They provide information on various investment products, help you assess your risk tolerance, and enable you to make investments that align with your financial goals and risk profile.

Exploring Some Top Financial Planning Apps

There’s a broad array of financial planning apps available in the market, each offering unique features and tools. Here’s a closer look at a few notable ones:

1. Mint

Mint is a versatile app that offers a broad range of features, from budgeting and expense tracking to credit score checks. Its easy-to-understand graphs and charts offer a comprehensive overview of your financial health.

2. YNAB (You Need A Budget)

YNAB operates on a unique philosophy of “Give Every Dollar a Job,” encouraging you to assign a specific purpose to each dollar you earn. This proactive approach helps prevent overspending and enables efficient money management.

3. Personal Capital

Personal Capital provides a blend of budgeting tools and investment management features. It’s especially beneficial for those looking for long-term financial planning, as it offers a retirement planner and an investment checkup tool.

4. PocketGuard

PocketGuard is designed to prevent overspending by showing you how much you can safely spend after accounting for your bills, goals, and regular spending.

5. Finaciti

Finaciti offers a suite of financial wellness tools, including budgeting, expense tracking, and debt management. What sets it apart is its inclusion of financial training modules and live coaching, offering a holistic approach to financial wellness.

Conclusion

Navigating the often-turbulent waters of personal finance can seem daunting, but it doesn’t have to be. Financial planning apps are like having a personal financial advisor in your pocket. They empower you with the tools, insights, and resources to manage your money with ease and make informed financial decisions. So why wait? Take control of your financial future and experience the power of a financial planning app today!