Hynix Yoy 4.7b 2.3b

Hynix Yoy 4.7b 2.3b has sparked industry interest and raised questions about the underlying factors driving this shift in financial performance. The company’s ability to navigate market dynamics and effectively manage its operations amidst a competitive landscape suggests a deeper narrative worth exploring. As we delve into the implications of Hynix’s financial transformation, a closer look at the strategies employed and potential market impacts emerges, offering insights into the company’s future trajectory within the semiconductor sector.

Factors Driving Hynixs Revenue Growth

The significant surge in Hynix’s revenue can be attributed to a combination of increased market demand, strategic pricing strategies, and operational efficiency improvements.

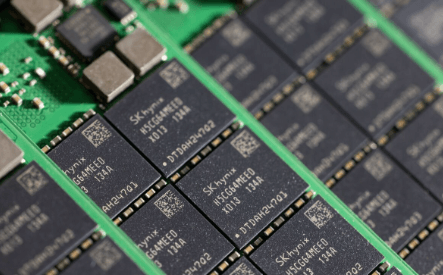

Hynix’s innovation leadership and technological advancements have positioned it favorably to meet global demand. Additionally, the company’s focus on supply chain optimization has further enhanced its ability to fulfill orders efficiently, contributing to its revenue growth.

Market Position and Competitive Edge

Hynix’s market position and competitive edge are underscored by its innovative technology leadership and strategic operational efficiencies. This solidifies its stance in meeting global demand and outperforming competitors.

The company’s strong market share is a result of its continuous technological advancements, allowing it to stay ahead in the industry. These factors enable Hynix to maintain a competitive edge and sustain its growth trajectory.

Read Also Ccdata Coinbase Yoy Q3 Coinbase Aprilkharifbloomberg

Strategies for Sustainable Profitability

With a focus on cost optimization and market diversification, Hynix implements strategic measures to ensure sustainable profitability amidst dynamic industry landscapes.

By prioritizing corporate sustainability and adopting growth strategies, the company aims to secure its position in the semiconductor market.

These initiatives not only enhance financial performance but also fortify Hynix’s resilience against market fluctuations, positioning it for long-term success.

Implications for the Semiconductor Industry

Given Hynix’s strategic focus on cost optimization and market diversification for sustainable profitability, the implications for the semiconductor industry are significant in terms of competitive positioning and market dynamics.

This move could impact innovation within the industry by driving competitors to enhance their own cost-efficiency strategies. Additionally, any supply chain disruption caused by these shifts could prompt a reevaluation of sourcing strategies across the semiconductor sector.

Conclusion

In conclusion, Hynix Yoy 4.7b 2.3b demonstrates its successful implementation of strategic pricing, operational efficiencies, and innovation in the semiconductor industry.

With a focus on market opportunities and supply chain optimization, Hynix is poised to sustain its competitive edge and drive continued profitability.

This growth trajectory, fueled by technological advancements and effective strategies, positions Hynix as a key player in shaping the future of the semiconductor industry.