All The Things You Need To Know About NVDA Stock Forecast

NVDA stock is one of the most popular investments right now. It has a lot of potential and expects to bring in a lot of revenue for shareholders. The NVDA stock forecast for 2020 looks promising, so many investors look forward to seeing what happens with this company over the next few years.

It has a reputation for being an innovative company. It has grown from its beginnings in 1993 to become a leader in the gaming, professional visualization, data center, automotive, and consumer electronics markets. It is the world’s leading visual computing company.

The NVIDIA GPU technology powers over 80 percent of the world’s supercomputers and over 295 million gaming PCs worldwide. The company also develops AI solutions deployed in cloud services by Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, to name a few. Thus, developers can build artificial intelligence applications on their platforms using technologies such as CUDA-X12 or TensorRT4 for accelerating deep learning models on GPUs. Keep reading to know amore about this stock.

Shareholders highly anticipate this NVDA stock forecast.

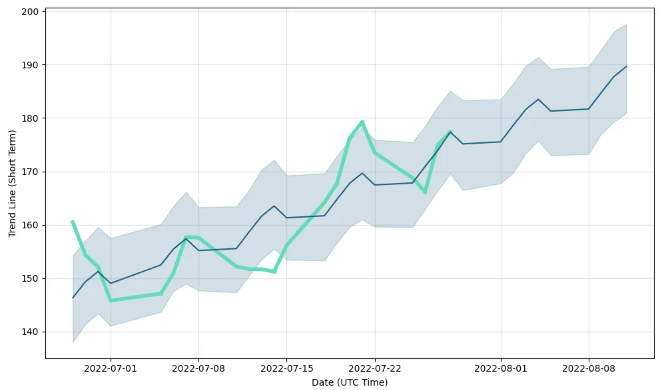

NVDA stock forecast 2020, 2021, 2022, 2023, 2024, 2025 and 2026. Investors are highly anticipating this forecast as it can help them to make better decisions on when to buy or sell stocks.

The first quarter of 2020 will be a rough one for this stock. The company’s top-line growth is expected to fall to 6.4% from 10.3% in Q1 2019, which could result in a decline in profits per share of 13%. However, by the end of 2020, it expects revenues to return above $12 billion again and expects earnings-per-share growth over that time frame.

NVDA Stock Forecast 2021

In 2021, Nvidia was expected to see substantial revenue growth relative to its previous four quarters (Q1 2020 – Q2 2021). This trend will likely continue throughout 2022 before flattening again through 2023 and 2024 before rebounding slightly towards 2025 compared to the prior year’s performance levels.

NVIDIA’s record earnings make the NVDA stock forecast for 2020 even more appealing to investors.

Investors in NVDA stock, who saw a 17% return on their investment for 2019 and have benefited from $8.5 billion in market cap gain, will be able to continue enjoying its share price growth as the company’s current year results are expected to be better than last year.

The forecast for 2020 remains bullish as long as NVIDIA continues to progress towards its goal of achieving $1 trillion in revenue by 2023. This would represent an increase of over 12% per annum and more than double what it is today (around $500 billion).

Projected Q1 growth will help the NVDA stock value.

It grew by 12.4% in Q1 2019, which would improve over the previous quarter’s (Q4 2018) growth of 10%. This figure surpasses NVIDIA’s sales forecast of 9% for all of 2019.

In addition to its impressive projected growth, this estimate assumes that NVIDIA will continue a consistent trend it has established in recent years: beating analysts’ expectations for revenue and earnings per share by about 5%.

Final Words

The NVDA stock forecast is an excellent indicator for investors. This forecast is an essential tool for analyzing future performance. It helps shareholders make better investment decisions.