What is Property Tax and How it is Calculated

For many years, property tax has been recognized across the world. Well, most of you might have a rough idea about it, but it is crucial to know all about it and how it works. This is because one day, you’ll own the key to your real estate property.

In general, the government levy taxes, such as property tax, income tax, etc., on their citizens to generate income for several projects for an economic boost and to upscale the living standard of the citizens.

However, with digitalization in recent years and the increasing penetration of internet-enabled smartphones, the government has ensured that paying property tax becomes easy and hassle-free with digital payments. So, property tax online payment can be made from anywhere and anytime.

What is Property Tax?

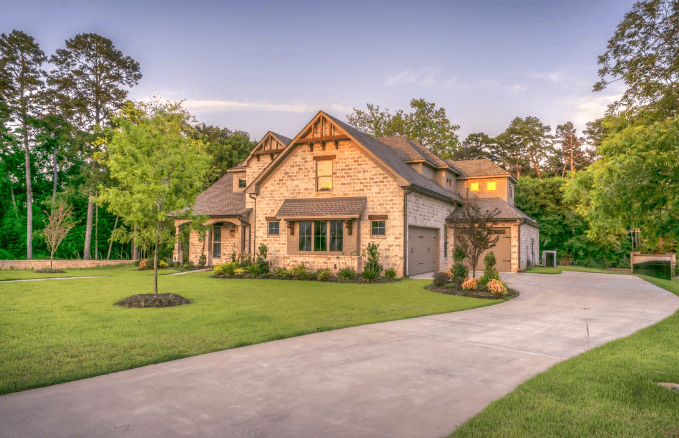

Like every other kind of tax, a property tax is to be paid every year and is charged by the government on all tangible property an individual owns. Notably, property here refers to any physical real estate such as houses, office buildings, etc. Furthermore, it depends on the government policy whether the tax would be paid to the local state government or the Municipal Corporation (MC).

(Tip 1: You can pay property taxes online or even offline. Going online is highly advisable and effortless)

How is property tax calculated?

Well, unlike the income tax, the property tax has a lot of factors that come into play to calculate it. From property’s base value to the built-up area and whatnot. However, before paying the tax on your valuable piece of property, it is essential to know on what basis it is calculated.

It is based on its valuation and appraisal depending on the locality in which a person resides. The tax amount varies as per the locality’s type of levy, amenities available, and other similar factors. When you have this information, you can calculate it yourself before making a property tax online payment to crosscheck whether you are on the right track.

The formula for Municipal Tax calculation is –

Property’s base value X Building type X Age factor X Built-up area X Floor factor X Use category.

(Tip 2: As this is a manual method, you can also check it via specific online tools before making the property tax online payment.)

What are the different methods of calculating property tax?

● Capital Value System (CVS)

Under this system, the tax is calculated as a percentage of the market value of the property. The market value is decided by government officials on the basis of the locality. Buy Cheap Oxycodone Online

● Unit Area Value System (UAS)

The Unit Area Value System is calculated based on the per unit price of the property’s built-up area. The price is decided on the basis of the expected returns of the property as per its usage, location, and land price. Further, this value is multiplied with the built-up area of the property to derive the tax valuation.

● Ratable Value System (RVS)

Here, the tax is calculated based on the rental value derived from the property in a year. Remember, this need not be the actual rent amount that is collected from the property. Instead, it is the rent valuation determined by the municipal officials and is derived based on the location, size, and condition. Other factors taken into consideration are landmarks and relevant amenities.

What are the steps for property tax online payment?

The internet has made a significant impact on how everything functions, and it has simplified a lot of lives. For example, gone are the days when paying property tax was tedious. Now, the whole procedure of digitally paying property tax is relatively easy, and one can do it with a few taps on a smartphone. Here, I’ll share my experience and how I file property tax every year.

- Download the ‘Bajaj Finserv: UPI, Pay, Loans’ application. (Available on both Play Store and App Store)

- Sign up with your details

- Go to the Bills & Recharges section

- At the bottom, go to Municipal Taxes

I’m sharing this example as I have been using this application for almost six months. Totally reliable and highly recommended if you do your payments digitally.