What are trendlines? Let’s know about it

Charts usually are supplemented with extra info in the type of graph representations. Trendlines are a great illustration. They are lines drawn above or under a cost (often in the cost), utilized to offer indications of the direction immediately and also to suggest upcoming pattern variations. Trendlines could be utilized to widen and close positions, in addition, to supply resistance and support. If you are just starting out with Bitcoin trading, you may do it with complete assurance using Bitcoin Formula.

Understanding Trendlines

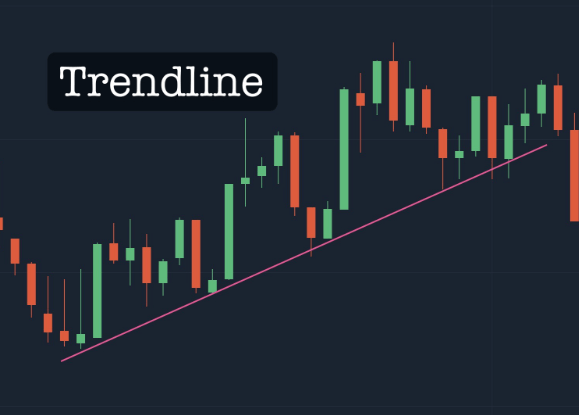

You have to be knowledgeable of the patterns which are following the market to boost your chances of effectively trading. This can enhance your odds to be preferred by most market theories. As its title indicates, a trendline is a line viewed on the trading chart that can help determine earlier as well as possibly repeated market trends.

A trendline using a downward slope indicates that there’s a surplus source of the advantage, which could signify a bear market with rates dropping. In comparison, an upward trendline indicates that the need for the item is higher compared to the supply, which could signify a bull market with climbing costs. A lot of traders utilize trendlines to produce auto-buys at various levels as well as auto-sells.

How to draw a trendline?

Many experts favour smaller time frames, e.g. 1-5 minutes, while other people favour greater time frames, like even a month or maybe a week. The majority of time frames are the daily as well as the 4-hour time frame since big time frames are usually more dependable. Additionally, some analysts don’t consider time whatsoever.

They rather opt to look at market fashion based on tick intervals rather than time intervals. Trendlines may be utilized to determine trends in virtually any period, no matter the interval or timeframe. To set a trendline, an analyst must have a minimum of two high or maybe low points, ideally three or even much more, on a cost chart. Whenever the low or high areas become connected with a series, they ought to develop a straight line.

Resistance and Support

Support, as well as opposition, are specific cost amounts which the cost isn’t likely to cross in the technical assessment. Market analysts anticipate these levels by sketching a straight line linking several highs or lows. Subsequently, the series forecasts a level above what a price isn’t going to go up above (a resistance type) or drop below (a support line).

Not every assistance as well as resistance has to be horizontal. When the cost is going downwards, below the candlesticks, a slanted resistance trendline could be pulled linking several cost highs. The common notion would be that the cost is apt to breach the opposition more than a few times before breaking through with new highs.

However, in case the pattern is ascending, a support trendline could be drawn beneath the price, linking probably the lowest lows. The cost is anticipated to bounce back from support a couple of times before breaking down in due course.

Whenever the cost breaks by way of a resistance line, it could develop confidence as well as push costs higher. It may cause a sell-off anytime it damages a support line. Once a support level is split into phases, it becomes opposition, and also the other way round. However, it is known as an “s/r flip.”

Channels and Range

A channel is referred to as the difference involving parallel resistance and support trendlines. Based on the price curve, there are three various kinds of channels. A rising or even up channel is bordered by ascending support as well as opposition lines and also forecasts an uptrend.

A downward and downward channel is bordered by ascending trend lines and also looks to predict a downtrend. Whenever the coast operates dull for a while, it’s entrapped in a sideways or horizontal channel bordered by horizontal trendlines. Occasionally known as a selection, a horizontal channel may also be range.