Change to Live: Andrey Berezin’s Euroinvest Shows How to Diversify Properly

This year after geopolitical factors considerably influenced the economic conjuncture, Russian businesses faced several fundamental questions. Firstly, the term import substitution is particularly vivid here regarding its role in ensuring the country’s stable development under challenging circumstances. The second question is how to ensure stability and protection against turbulence. And here, perhaps, the most critical concept is diversification. There are quite a few companies in Russia that have experience in import substitution and have succeeded in diversification well before the rest of the market participants begin to even think about it. Today, we will tell you how the St. Petersburg holding company Euroinvest, owned by Andrey Berezin, has diversified distribution across different industries and directions.

Construction Foundation

Recall the prominent popularity of the investment company Euroinvest, acquired many years ago as a developer. Both experts and interested people know Euroinvest as the discoverer of now-famous names such as Kudrovo and Murino.

Although Andrey Berezin’s company was not the only (or even the largest) developer in these regions and cities, it was his idea to simultaneously build in large territories outside the city limits. In addition, let us note that Euroinvest organized the purchase of land shares from the then-owners, shareholders of local farms. After consolidating the obtained lands, they invited other construction participants to join them.

Since then, a lot of water has flowed, and the company has acquired the status of a well-deserved holding, opening some new work areas (as discussed below). It still remains one of the main driving forces behind the overall development of the holding.

This year’s global economic troubles did not cut this fruit-bearing vine, though it did curb its development. In an interview this summer, Andrey Berezin admitted that the story is declining because of compressed demand. Mortgage prices skyrocketed at the beginning of the year, and although the jump has leveled out since, it took some time for consumers to overcome market fears. Hence, the cautiousness in buying housing inevitably led to a decrease in market activity.

Nevertheless, regarding the prospects of the company’s development division, Berezin was optimistic.

“Generally, we have a stable situation, and we will commission all the objects. We have a few projects in the initial implementation stage, and their financing has no problems. For example, we received decisions from the credit committees to give us money for two projects in the city and one in the region. But we are not taking that money yet, because we want to see what will happen next. We have a lot of projects where we buy land or negotiate some kind of equity terms with the owners. When we go to the landowners, they understand that we can offer better terms because we build high quality and our apartment prices are higher than those of our competitors. But despite this, sales are increasing. The reason is that almost all of our houses are always delivered before the deadline. This position allows us to hold prices and to develop further. And everyone sees it!” he stressed.

In the quote above, the co-owner of Euroinvest did not speak in vain about better conditions and compliance with construction deadlines. This is indeed the case for the company, at least in recent years. These results are partly due to good management. For instance, a few years ago, Berezin and Vasilyev managed to hijack and attract Stanislav Danelyan, the former general director of Arsenal Real Estate, a competitor of Euroinvest in the construction market of St. Petersburg and the region.

But even more important is the intention to build not just quality housing, but housing with a set standard of quality of life, which was raised to the level of corporate ideology. At first glance, these notions are difficult to distinguish, but a detailed study will show a significant difference.

The second approach means that the developer is not just selling square meters and a few amenities outside the doorstep of the sold apartment. Instead, it offers a well-considered, integrated infrastructure that allows the owner to have a quiet lifestyle, raise children, communicate and, in general, organize life in all its manifestations of the residential living area.

Euroinvest realized such an approach in the form of the 3ID concept. In brief, it implies several essential innovations. Firstly, it is an active application of intelligent house technologies. The second is the significant volume and variety of public spaces in the yards and under the roof.

The third point is the most unique: we are talking about organizing regular communication and interaction between residents in a club format. For them, management companies create a permanent network of events: workshops, lectures, and film screenings to help people establish friendly communication and become aware of themselves as a community.

We don’t want to turn this text into an advertisement, so for those interested in the features of 3ID, we suggest finding more information on your own. But, let us just note that for at least the last three years, all the residential complexes that Euroinvest has built include the use of this concept.

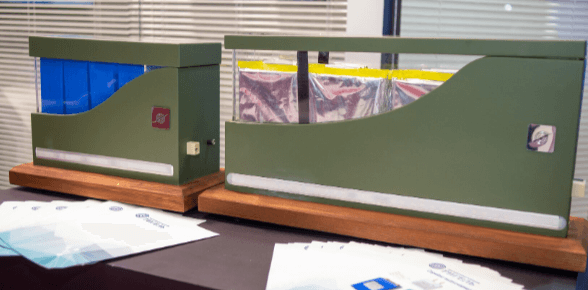

The most prominent of these developments have medical applications and are based on the use of X-rays. For example, the plant created a portable X-ray camera to quickly analyze tissue samples taken during surgery or biopsy to diagnose breast tumors. As for treating lung cancer, the radiation therapy device created by Svetlana specialists in collaboration with doctors from St. Petersburg hospitals and scientists from the city’s universities can be life-saving for many. Unlike other similar devices, it is intended for use directly during surgeries; the surgeon will be able to irradiate specifically diseased tissues without damaging neighboring tissues.

Considerably more of the plant’s developments are intended for use in the agricultural sector. In the farm sector, an X-ray camera will come in handy to assess the quality of seeds. Road construction uses a unit based on microwave radiation to heat the asphalt pavement. It is noted that it will be the first device capable of heating the entire thickness of asphalt at once, whereas the existing equipment heats only the surface layers.

This list could go on and on. Svetlana is not the only additional support that Euroinvest has used for successful diversification. Sometime later, it acquired the Rigel plant, which specializes in creating batteries and accumulators, and more recently, the Recond plant, which produces a wide range of radio components. Whereas investments in the development of the production base of the latter are still in progress, in the case of Rigel, they have already begun to bring significant results.

As an example, special traction lithium-ion batteries are produced for the Obukhov Plant, part of the Almaz-Antey Concern. They will be installed on electric vehicles based on the E-Neva platform developed by the Obukhov Plant, including electric drones.

Another exciting project will be implemented by Rigel and another well-known Russian developer and battery manufacturer, NIAI Istochnik. At the Army-2022 International Military-Technical Forum, the companies agreed to collaborate to create domestic batteries for smartphones and mobile devices.

Knowledge as a Commodity: Profitable and Safe

The industrial cluster was the most decisive step towards the diversification of Euroinvest’s business, but it would still be wrong, not to mention others.

Creation of the agricultural cluster began five years ago, but the lands themselves in the Dnovsky District of the Pskov Region had been purchased by the company several years earlier. The Krasnoye Znamya cluster included fields for sowing grain crops, a dairy herd, and, somewhat later, its dairy production line (the MoleMe brand).

In the first stage, about 120 million rubles were invested in the project, and the total planned amount of investment the company’s leaders estimated in 2017 at 300 million. However, since then, the bar has increased, among other things, by purchasing one of the neighboring farms’ facilities last year. It allowed Krasnoye Znamya to get new machinery and additional agricultural buildings.

Several facts are evidence of the success of the initiative. First, the cluster is considered by the Pskov Oblast administration among the most significant and most promising investment projects in the region. Secondly, despite the relatively small volume of production so far, Krasnoye Znamya has managed to create interest among some well-known and symbolically essential partners, including the Leningrad Zoo. According to the contract, the enterprise will supply the zoo with animal feed.

Has Euroinvest ever had any outright failures in finding new investment areas? Yes, you could say so. Among them was the purchase of a gold mine in an African country. But these failures were a helpful experience for the management team, which made it possible to draw meaningful conclusions for future investments.

Andrey Berezin shared some of these conclusions publicly. For example, any investment in production is possible only when there is a clear understanding of how the entire chain will function, starting with the supply of raw materials and components and ending with the sale of finished products. If even one of the elements is in jeopardy, the investment plans should be abandoned.

These same conclusions led the leadership of Euroinvest to the idea of investing not only in goods but also in knowledge. And today, it is this new “product” that the head of the holding division considers the most promising. In recent interviews, he insists that knowledge and competence will be the most important factors in the emerging technological mode, eclipsing both production capacities and sales markets.

Within the framework of this logic, the company consistently increases its presence in the knowledge market, which is not yet fully formed, experimenting with a variety of mechanisms for this purpose. Some of them are realized by Euroinvest together with other structures, such as in the framework of an agreement with leading St. Petersburg universities, a joint project with the L. Euler Foundation, and a contest for young talents under the aegis of the World Club of Petersburgers.

However, the longer it goes on, the more active the holding works on its own. For example, one of the first steps was the establishment of our scholarship for successful graduate students. This year, there was also a project to introduce health-saving technologies in one of the educational institutions of Gatchina. The project uses the achievements of domestic scientist and teacher, V. Bazarny, a specialist ambiguously but acclaimed by the professional community for his innovative courage.

Today, Andrey Berezin and his team are setting their sights on an entirely new height by announcing the construction of a real academy. The project’s authors have set a very ambitious goal: to make the academy one of the leading training centers for gifted children in St. Petersburg. To do this, the building will be built according to the most modern standards, and the teaching staff will be made up of the brightest stars of the profession.

Yes, this will certainly not be cheap for Euroinvest, but knowing its management’s business acumen and foresight, there is no doubt that the holding will receive its benefits. Maybe not in monetary terms, but in the possibility of becoming the first personnel buyer for the school’s best graduates.

Looking at the company’s activity in Russian education, one can assume that it marks the beginning of the big march of Russian business captains into the knowledge economy that Berezin is so fond of. And while the latter will only be entering this ocean, Euroinvest will already be profiting from the process.